Sony shuts down CD manufacturing plant in NJ – the headline alone screams the end of an era. For decades, this New Jersey facility churned out millions of CDs, the soundtrack to countless lives. Now, the silence of its empty production lines reflects a larger shift in the music industry, a move away from physical media towards the digital realm. This closure isn’t just about a factory; it’s a poignant reminder of how technology reshapes our world, leaving behind both economic ripples and nostalgic echoes.

The impact stretches far beyond Sony’s bottom line. Job losses, supply chain disruptions, and the future of physical media itself are all in the spotlight. We’ll dive into the financial implications for Sony, explore the dwindling CD market, and examine the support being offered to displaced workers. But beyond the numbers, we’ll also consider the environmental consequences of this closure and the broader technological shifts that have made this moment inevitable.

The Impact on Sony’s Business

Sony’s decision to shutter its CD manufacturing plant in New Jersey carries significant implications for the company, extending beyond the immediate closure. The move reflects broader shifts in the music industry and the technological landscape, forcing a reassessment of Sony’s manufacturing strategy and resource allocation.

The closure will undoubtedly have financial implications. While the exact figures remain undisclosed, the plant’s operational costs, including labor, utilities, and maintenance, will be eliminated. However, these savings must be weighed against potential losses from reduced production capacity, increased reliance on external suppliers, and potential disruption to the supply chain. The transition costs associated with relocating production and managing the closure itself also need consideration. We can speculate that Sony might see short-term losses related to severance packages and equipment write-offs, but long-term savings are anticipated if the move aligns with a broader cost-optimization strategy.

Financial Implications of the Plant Closure

The financial impact is multifaceted. Direct costs associated with the closure, such as severance payments to employees and the disposal or repurposing of equipment, will be substantial. Indirect costs, including potential delays in fulfilling orders and the need to renegotiate contracts with external manufacturers, could also significantly impact profitability. A thorough cost-benefit analysis, comparing the ongoing operational costs of the New Jersey plant with the projected costs of outsourcing or consolidating production elsewhere, likely informed Sony’s decision. The long-term financial outcome will depend on the efficiency of the new production arrangements and the continued demand for physical CDs. For example, if Sony experiences significant delays in production, leading to lost sales and damaged customer relationships, the financial repercussions could outweigh the initial cost savings.

Effect on Sony’s Supply Chain and Manufacturing Capabilities

The closure impacts Sony’s supply chain by reducing its in-house CD manufacturing capacity. This increases reliance on third-party manufacturers, potentially introducing vulnerabilities related to production delays, price fluctuations, and quality control. Maintaining consistent production levels and meeting consumer demand will now require stronger partnerships and more robust contingency plans. The success of this transition will hinge on Sony’s ability to establish reliable relationships with external suppliers who can match the quality and production capacity of the closed plant. A disruption in the supply chain could lead to stock shortages, missed deadlines, and damage to Sony’s reputation. Consider, for instance, a scenario where the chosen external manufacturer experiences unexpected production issues; Sony’s ability to respond effectively would be tested.

Comparison of Production Capacity

Precise production figures for the New Jersey plant and other Sony facilities are not publicly available. However, we can infer that the closure represents a significant reduction in Sony’s overall CD manufacturing capacity. The plant likely held a substantial portion of Sony’s North American CD production, meaning other facilities will need to absorb this increased workload. The effectiveness of this redistribution will depend on the capacity and efficiency of these alternative sites, along with the ability to adapt production lines and logistics to accommodate the increased demand. A potential bottleneck could arise if the existing facilities lack the capacity to handle the added production volume without compromising quality or delivery times.

Types of CDs Manufactured and Market Share

The New Jersey plant likely produced a range of CDs, including music, software, and potentially data storage discs. Determining the precise market share held by this specific plant is difficult without access to internal Sony data. However, the overall market share for physical CDs has been declining steadily, indicating that the plant’s contribution to Sony’s overall revenue was likely shrinking. The shift towards digital music distribution and streaming services has significantly impacted the demand for physical CDs, making the closure a strategic response to a changing market landscape. The precise mix of CD types produced would influence the impact of the closure, with some product lines potentially more vulnerable to supply chain disruptions than others.

Hypothetical Mitigation Plan

To mitigate the impact, Sony could implement a multi-pronged strategy. This would include securing contracts with multiple, geographically diverse CD manufacturers to diversify its supply chain and reduce reliance on any single supplier. Investing in automation and streamlining processes at remaining facilities could improve efficiency and help offset the lost capacity. Finally, a robust inventory management system would help predict and address potential supply shortages, minimizing disruptions to customer orders. Furthermore, proactively communicating with key stakeholders, including retailers and distributors, would help manage expectations and maintain positive relationships. This comprehensive approach would help minimize the negative effects of the plant closure and ensure a smoother transition to a new production model.

The Future of Physical Media

The closure of Sony’s CD manufacturing plant in New Jersey marks a significant moment, not just for Sony, but for the entire physical media landscape. The decline of CDs has been a long and steady trend, reflecting broader shifts in consumer behavior and technological advancements. Understanding this decline, and predicting the future of physical media, requires looking at the interplay of various factors.

The long-term trend shows a dramatic shift away from physical media towards digital downloads and streaming services. While vinyl records have experienced a surprising resurgence among audiophiles and collectors, the CD market continues its downward spiral. This isn’t simply about convenience; it’s a complex interplay of evolving consumer preferences, technological disruptions, and the sheer cost-effectiveness of digital distribution.

Factors Contributing to the Decline of the CD Market, Sony shuts down cd manufacturing plant in nj

The shrinking CD market is a result of several interconnected factors. The rise of digital music platforms like Apple Music, Spotify, and YouTube Music offers consumers unparalleled convenience and vast music libraries at a relatively low cost. Streaming’s accessibility and affordability are undeniable advantages. Furthermore, the superior audio quality offered by high-resolution digital formats, accessible through dedicated streaming services or high-fidelity downloads, also contributes to the decline of CD’s perceived value proposition. The compact disc, once the pinnacle of audio technology, now faces competition from digitally superior alternatives. Finally, the shift to mobile devices and digital storage solutions has reduced the need for physical media storage, further diminishing CD sales.

Predictions for the Future of CD Manufacturing and Distribution

While CD manufacturing is unlikely to disappear entirely, it will almost certainly continue its decline. We can expect niche markets, such as collectors’ editions of albums or limited-release recordings, to remain. However, mass production and widespread distribution of CDs will likely become increasingly rare, with manufacturing concentrated in fewer, larger facilities. The industry might see a shift towards “on-demand” CD pressing, similar to print-on-demand services for books, where CDs are only produced once an order is placed. This model minimizes storage and inventory costs, making it more economically viable for smaller runs. This shift would mirror the transition seen in other industries where digital technologies have disrupted traditional manufacturing processes.

Alternative Uses for the Vacated Manufacturing Facility

The Sony plant’s closure presents an opportunity for repurposing the facility. Given its size and location, several possibilities exist. It could be converted into a warehouse for e-commerce operations, leveraging its existing infrastructure. Alternatively, it could be transformed into a data center, capitalizing on the growing demand for cloud computing services. The facility’s existing infrastructure might be easily adaptable for these purposes. Another option could be redevelopment as a light industrial or manufacturing space for other industries, potentially attracting new businesses and creating jobs in the local area. The specific best use would depend on market demand and local zoning regulations.

Timeline of Significant Events in the History of CD Manufacturing

The history of CD manufacturing reflects a technological evolution that ultimately led to its decline.

- 1982: The first commercially available compact discs are released, marking the beginning of a new era in music consumption.

- Late 1980s – 1990s: CDs rapidly gain popularity, surpassing vinyl records and cassette tapes as the dominant music format. This period witnesses a massive expansion of CD manufacturing facilities globally.

- Early 2000s: The rise of digital music downloads begins to impact CD sales, offering consumers a more convenient and often cheaper alternative.

- Mid-2000s – Present: Streaming services become increasingly popular, significantly impacting CD sales and leading to the closure of many manufacturing plants worldwide. The decline accelerates as consumers embrace the convenience and vast libraries offered by platforms like Spotify and Apple Music.

Employee Impact and Relocation

The closure of Sony’s CD manufacturing plant in New Jersey will undoubtedly have a significant impact on its employees. The precise number of affected workers hasn’t been publicly released by Sony, but reports suggest it’s in the hundreds, potentially impacting both production line workers and administrative staff. Understanding how Sony handles this transition is crucial, not only for the individuals directly affected but also for its public image and future workforce morale.

Sony’s response to this workforce displacement will be a key indicator of its corporate social responsibility. The company has several options to support its employees during this difficult time, ranging from financial assistance to career development opportunities. The approach they take will shape public perception and potentially influence future employee loyalty and recruitment.

Severance Packages and Benefits

Sony will likely offer comprehensive severance packages to its employees. These packages could include extended health insurance coverage, outplacement services, and financial compensation based on years of service and position. The generosity of these packages will significantly impact the employees’ ability to transition smoothly to new employment. For example, a robust severance package might include a significant lump-sum payment, along with career counseling and access to job search platforms, mirroring the practices of other large corporations during similar situations. A less generous package could lead to increased hardship for affected employees and negative publicity for Sony.

Retraining and Reskilling Programs

Given the changing landscape of the manufacturing and technology sectors, Sony could offer retraining and reskilling programs to help employees adapt to new career paths. These programs could focus on in-demand skills in areas such as logistics, data analysis, or renewable energy, reflecting the company’s potential diversification efforts. For example, a partnership with a local community college or a specialized training institute could provide employees with valuable certifications and enhance their job prospects. The success of such programs would depend on their relevance to the current job market and the employees’ willingness to embrace new opportunities.

Relocation and Reassignment Opportunities

While the New Jersey plant closure is permanent, Sony might offer relocation opportunities to employees willing to transfer to other Sony facilities, both domestically and internationally. This would depend on the availability of suitable positions and the employees’ willingness to relocate. Alternatively, Sony could explore internal reassignment opportunities within its other New Jersey operations or elsewhere in the US. However, this is contingent on having open positions that match the skills and experience of the displaced workers. The success of this approach depends on transparent communication about available positions and the company’s willingness to provide support for relocation expenses.

Communication Strategy for Affected Employees

Effective communication is crucial during this transition. Sony should implement a structured communication plan that includes:

- Initial Announcement: A clear and concise announcement of the plant closure, including the timeline and reasons for the decision.

- Individual Meetings: One-on-one meetings with affected employees to discuss severance packages, retraining options, and potential relocation opportunities.

- Regular Updates: Consistent updates on the progress of the transition process, including resources available to employees.

- Open Forums: Opportunities for employees to ask questions and voice concerns.

- Ongoing Support: Continued support and resources for employees even after the transition is complete.

This multi-pronged approach ensures transparency and provides support throughout the entire process, minimizing disruption and uncertainty for the affected employees.

Environmental Considerations

The closure of Sony’s CD manufacturing plant in New Jersey presents a complex environmental picture. While ceasing production reduces the environmental footprint associated with CD manufacturing, the closure itself necessitates careful management of waste and adherence to stringent environmental regulations. The process requires a balanced approach, mitigating potential negative impacts while maximizing opportunities for sustainable practices.

Waste Disposal and Recycling Procedures

Sony faces the significant challenge of responsibly disposing of or recycling a substantial amount of waste materials accumulated over the plant’s operational lifespan. This includes various plastics, metals, chemicals, and electronic components. The company must meticulously categorize this waste, adhering to local, state, and federal regulations regarding hazardous waste disposal. Efficient recycling programs are crucial to minimize landfill contributions and reduce the overall environmental burden. For example, plastics can be sorted and processed for reuse in other products, while metals can be smelted and repurposed. The successful implementation of such programs will significantly influence the environmental legacy of the plant’s closure.

Environmental Regulations During Plant Closure

Sony’s closure process must strictly comply with a range of environmental regulations, including those governed by the Environmental Protection Agency (EPA) and the New Jersey Department of Environmental Protection (NJDEP). These regulations encompass air emissions, water pollution, hazardous waste management, and soil remediation. Non-compliance can result in substantial penalties and reputational damage. The company is likely required to submit detailed closure plans outlining waste management strategies, remediation efforts for potential soil or groundwater contamination, and decommissioning procedures for equipment and infrastructure. Detailed environmental impact assessments are also likely required to demonstrate the minimized environmental impact of the closure.

Sony’s Environmental Sustainability Initiatives

Sony has publicly committed to various environmental sustainability initiatives, and the closure of this plant provides an opportunity to showcase these commitments. These initiatives may include partnerships with certified recycling facilities, investment in advanced waste treatment technologies, and transparent reporting of environmental performance metrics related to the closure. The company might leverage this closure as a case study to highlight its broader sustainability goals, potentially integrating lessons learned into future manufacturing processes and plant closures. For example, they might publish a detailed report outlining the environmental impact of the closure, the recycling rates achieved, and the lessons learned for future operations.

Potential Environmental Benefits and Drawbacks

Ceasing CD production at this location presents both benefits and drawbacks from an environmental perspective. A key benefit is the reduction of greenhouse gas emissions associated with manufacturing, transportation, and the eventual disposal of CDs. However, the closure process itself could lead to temporary increases in waste generation and transportation, unless meticulously managed. The potential for soil or groundwater contamination from past operations also needs to be addressed through thorough remediation. A successful closure, emphasizing recycling and minimizing environmental impact, will outweigh the potential drawbacks and showcase Sony’s commitment to environmental responsibility.

Waste Management Summary Table

| Waste Type | Quantity (Estimate) | Disposal Method | Environmental Impact |

|---|---|---|---|

| Plastics | 10,000 kg (example) | Recycling (Specialized facility) | Reduced landfill burden, potential for material reuse |

| Metals | 5,000 kg (example) | Recycling (Smelting and repurposing) | Conservation of resources, reduced mining impact |

| Hazardous Waste (e.g., chemicals) | 1,000 kg (example) | Specialized disposal facility (in compliance with EPA and NJDEP regulations) | Minimizes risk of soil and water contamination |

| Electronic Waste | 2,000 kg (example) | Certified e-waste recycler | Recovery of valuable materials, reduced landfill burden |

Technological Advancements and Alternatives

The closure of Sony’s CD manufacturing plant underscores a larger shift in the music industry, driven by relentless technological advancements that have rendered physical media less dominant. The decline of CD production isn’t simply about changing consumer preferences; it’s a complex interplay of technological leaps and evolving consumption habits.

The rise of digital music platforms like iTunes and Spotify, coupled with improvements in audio compression and streaming technologies, significantly impacted CD sales. Higher-quality digital audio formats, such as FLAC and ALAC, offered lossless audio comparable to CDs, negating the perceived quality advantage of physical media for many listeners. Simultaneously, the convenience of accessing vast music libraries on demand through smartphones and other portable devices proved irresistible to a large segment of the population.

Comparison of CD Manufacturing with Other Media

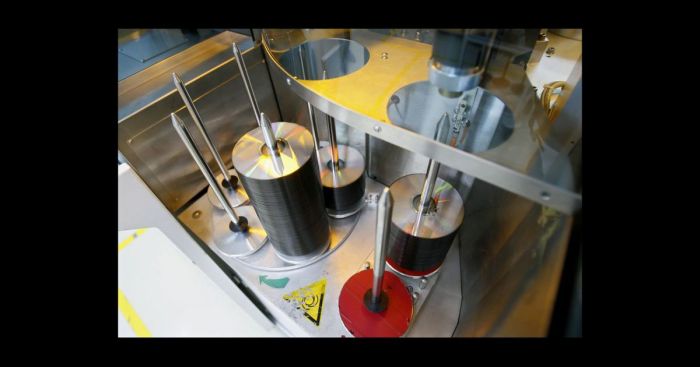

CD manufacturing involves a multi-step process, starting with the mastering of audio onto a glass master disc, followed by metal stamping to create a mold, and finally, the injection molding of plastic discs with the replicated audio data. This process is relatively expensive and labor-intensive compared to digital music production and distribution. Vinyl record production, while experiencing a resurgence, also involves a complex process of mastering, lacquer cutting, plating, and pressing, making it more expensive than CD production. Digital music, however, requires minimal physical production; the creation of digital audio files involves only software and computer hardware, with distribution handled entirely electronically. This makes digital music significantly cheaper to produce and distribute than either CDs or vinyl records.

A textual comparison of the manufacturing processes highlights the differences:

| Media Type | Process | Cost | Scalability |

|—————–|—————————————————————————|—————|————-|

| CD | Mastering, metal stamping, injection molding | Relatively High | Moderate |

| Vinyl Record | Mastering, lacquer cutting, plating, pressing | High | Low |

| Digital Music | Digital audio file creation, online distribution | Very Low | Very High |

Potential Future Technologies

While CDs are fading, several technologies could potentially fill the niche, either as replacements or complements. High-resolution audio streaming services, offering significantly higher fidelity than standard streaming, are gaining traction. Lossless audio codecs continue to improve, allowing for higher-quality digital music files without significant increases in file size. Furthermore, advancements in data storage technologies, such as holographic storage, could potentially offer extremely high-capacity storage solutions for music, albeit at a likely higher cost initially. The adoption of blockchain technology for digital rights management could also transform the music industry, creating more efficient and transparent systems for artists and consumers.

Implications for the Music Industry

The technological shift away from physical media has profoundly impacted the music industry’s business model. The dominance of streaming services has led to lower revenue per stream for artists, prompting debates about fair compensation and the sustainability of the current model. The industry has had to adapt, exploring new revenue streams such as merchandise, live performances, and direct-to-fan engagement. However, the transition has also presented opportunities for independent artists to bypass traditional record labels and reach audiences directly through digital platforms. The future of the music industry likely lies in a hybrid model, incorporating both physical and digital formats, with a continued focus on technological innovation to enhance the listening experience.

Final Review: Sony Shuts Down Cd Manufacturing Plant In Nj

The closure of Sony’s New Jersey CD plant marks more than just the end of an era; it’s a powerful symbol of the digital revolution’s relentless march. While the economic and social impacts are undeniable, the story also offers a glimpse into the future of manufacturing, the evolving relationship between technology and employment, and the ever-changing landscape of the music industry. It’s a complex story, full of both challenges and opportunities, and one that will undoubtedly continue to unfold in the years to come.